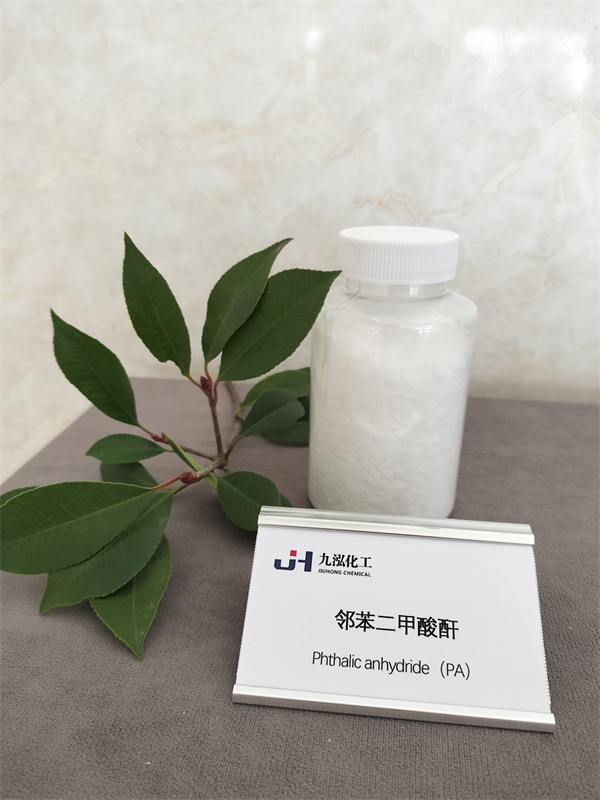

Phthalic Anhydride For Painting Additive

CAS No.85-44-9

Purity:≥99.5%

Molecular Formula:C8H4O3

Phthalic anhydride, referred to as PA, a white scaly or crystalline powder. Phthalic anhydride is an important raw material in chemical industry, especially used in the manufacture of plasticizers, like Dibutyl phthalate and dioctyl phthalate.

Parameter

Technical standard GB/T 15336-2013

Index name | Index | ||

Superior products | First-grade products | Qualified products | |

Appearance | White flake or crystalline powder | Scaly or crystalline powder with other colors | |

Molten chroma ≤ | 20 | 50 | 100 |

Thermal stability chroma ≤ | 50 | 150 | — |

Sulphuric acid chroma≤ | 40 | 100 | 150 |

Crystallization point, ℃ ≥ | 130.5 | 130.3 | 130.0 |

Purity,% ≥ | 99.5 | 99.5 | 99.5 |

Mass fraction of free acid,% ≤ | 0.20 | 0.30 | 0.50 |

Product Performance and Application

Phthalic anhydride, short as PA, a white scaly or crystalline powder. Its Molecular formula is C8H403, molecular weight is 148.12, melting point is 131.1l ℃, boiling point is 284.5 ℃, flash point is 151 ℃ (closed) and 165 ℃ (open), spontaneous ignition point is 584 ℃and density (solid) is 1.527g/cm3. It is insoluble in cold water and soluble in hot water, ethanol, ether, benzene and other organic solvents.

Phthalic anhydride is an important raw material in chemical industry, especially used in the manufacture of plasticizers like DBP and DOP etc. can also be used together with other materials in the manufacture of products like resin, paint, glass fiber reinforced plastics. At the same time, It also is the raw material of benzoic acid and terephthalic acid.

About the package

About the package, we have two kinds of packages for you,

1. 25kg small bag, it is more concient to use.

2. 500kg big bag, it is more economical.

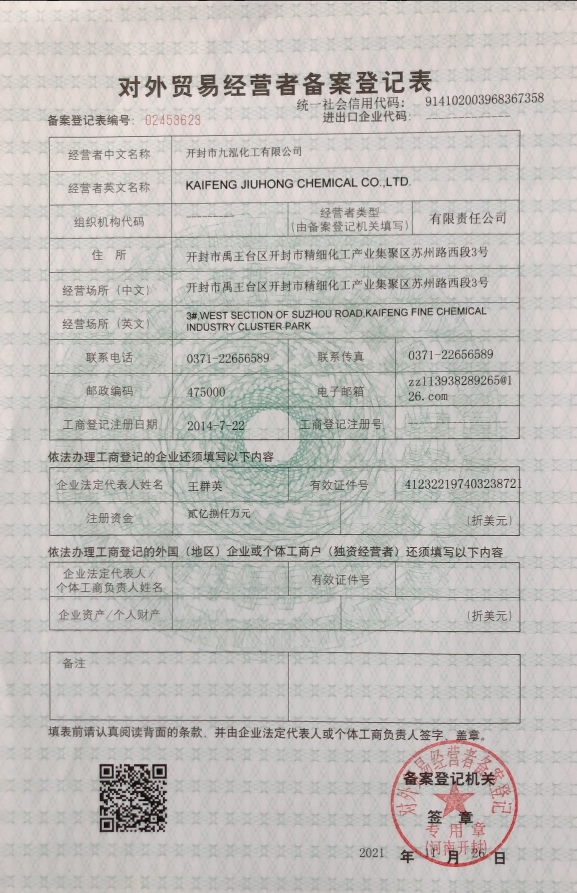

About the Foreign Trade Licence

The Foreign Trade Licence is equivalent to the import and export qualification of an enterprise. The enterprise needs it either in handling the import and export of technology, or handling import and export of goods or international service trade business. At the same time, It is also an necessary data while the company needs to open a foreign exchange account in the bank or do the tax refund registration.The advantages are as follow:

1. With import and export rights, enterprises can independently declare customs and import and export goods.

2. If import and export enterprises are general taxpayers, they can also obtain export tax refunds, which is a significant profit and the basic purpose for many enterprises to handle import and export rights.

3. Being able to open a foreign exchange account and freely receive and receive foreign exchange is beneficial for enterprises to step onto the international stage.

4. Can apply for government subsidies based on customs data.

FAQ

Q1: Are you the trading company or manufacturer ?

A: We are the manufacturer.

Q2: Can I get a free sample?

A: Yes, a sample less than 2 kg is free, you only need to pay the delivery cost.

Q3. What is your terms of payment?

A:We prefer TT, 30% as deposit, and 70% before delivery. but other ways is also negotiable.

Q4: How long is your delivery time?

A: We can do the delivery as soon as the payment.

Q5. Do you test all your goods before delivery?

A: Yes, we will test the product at least 3 times during the producing, And before delivery we will test it again.